Leveraging Data Visualization to Equitably Support Small Businesses Impacted by COVID-19

Fellow Spotlight: Kiki Yalamanchili

May 1, 2020

Fellow Spotlight: Lydia O’Connell

June 1, 2020Leveraging Data Visualization to Equitably Support Small Businesses Impacted by COVID-19

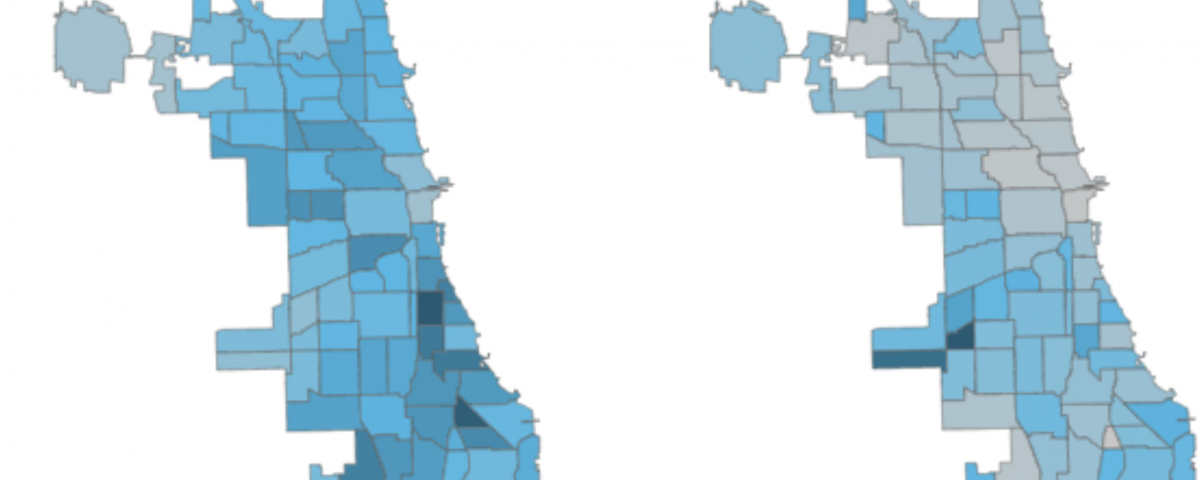

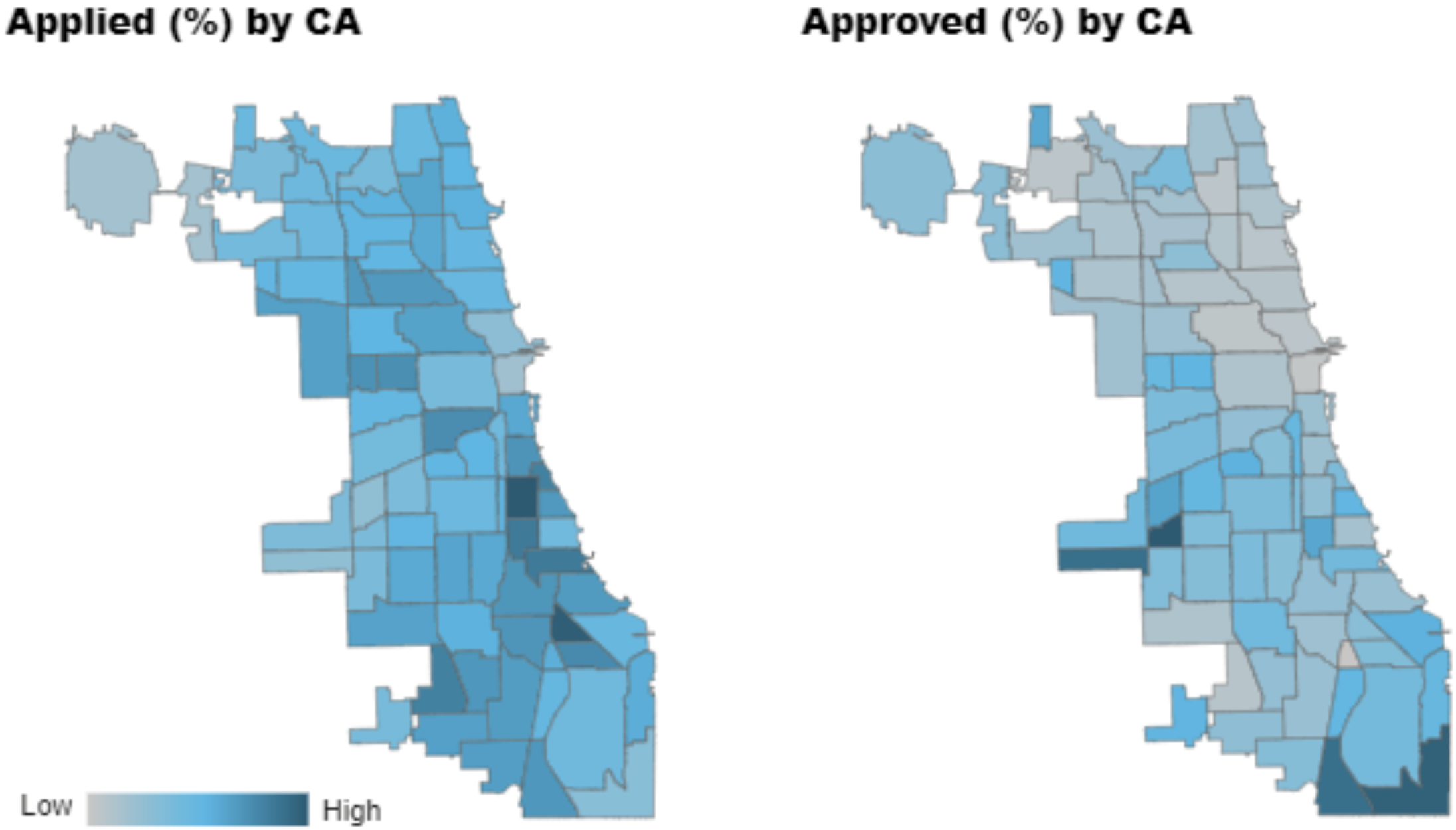

Maps from the Chicago Small Business Resiliency Fund dashboard show the percent of small businesses that applied (left) and the percent of applications approved (right) by community area (CA). The difference between the maps reflects the impact of the City’s equity framework.

When the COVID-19 pandemic struck Chicago earlier this year, thousands of restaurants, shops, salons, and other small businesses were required to shut their doors as part of the public health response. In an effort to support Chicago’s entrepreneurs through this crisis, in April and May, the City launched two programs:

- The Chicago Small Business Resiliency Fund to provide $100 million of emergency cash to small businesses and nonprofits through loans of up to $50,000; and

- The Microbusiness Recovery Grant Program to provide $5,000 grants to up to 1,000 small businesses that cannot afford to take on debt during this challenging time.

Demand for these programs greatly exceeded available funding, with more than 4,500 Microbusiness Grant applications received alone.

“We were committed to distributing funds using an equity framework. We needed a tool to make informed, systematic decisions, and to assess if we were achieving that goal.”

— Kenya Merritt, Chief Small Business Officer

Civic Consulting Alliance and our pro bono partner Slalom worked with Kenya and her team to build dashboards to track the number of applicants, which neighborhoods they represented, and the demographics of applicants—including race, gender, and industry.

“The dashboards enabled us to visualize applications and fund disbursements, so that we could ensure that funding was reaching a diverse group of business owners across the city, and particularly those communities most in need.”

— Kenya Merritt, Chief Small Business Officer

Maps from the Chicago Small Business Resiliency Fund dashboard show the percent of small businesses that applied (left) and the percent of applications approved (right) by community area (CA). The difference between the maps reflects the impact of the City’s equity framework.

As a result, approximately 55% of the businesses that received a Microbusiness Grant are owned by women, 45% of recipients are Black, and 34% are Latinx. On average, recipients have two employees and have been operating for 10 years.

The dashboards also support longer-term policymaking. The visualizations have allowed City leaders to understand which industries have the greatest need for financial support, and which communities may need more technical assistance in order to benefit from such programs in the future, given the small percentage of businesses that applied for funding in those areas.

The dashboards have also helped the City quickly and flexibly communicate data to stakeholders, such as the public and aldermen, so that they can adjust their efforts as may be needed in order to better support small businesses through the COVID-19 crisis.

Being able to understand and to respond to the needs of Chicago’s small businesses is critical as we move out of COVID-19 crisis response and into the recovery. This knowledge is even more significant in the wake of the death of George Floyd—which shone a bright light on our society’s stark inequities and structural racism, and which sparked vandalism that hurt many of the small businesses that were already struggling the most.

As our communities and small business owners continue to recover from these dual events, we hope that this work will support the City’s efforts to prioritize equity during a time of extreme need and urgency.